Book a Free Consultation

An end of year review of the most significant market events as we come to the end of an eventful year.

Brexit

On March 29 Article 50 of the Lisbon Treaty was invoked. Britain has until March 29, 2019 to negotiate the terms of its departure. Prime Minister Theresa May tried to boost Britain’s weak negotiating leverage this spring by calling an election. The decision backfired and her Conservative Party lost its parliamentary majority and ended up in a hung parliament with the help on Northern Irelands DUP. Recently, Britain and the EU reached an agreement on critical preliminary issues, including how much Britain has to pay to settle its debts to the EU thought to be in the region of 40 billion Euros.

Going forward, Britain and the EU will focus on the rules that will govern their future economic relationship. These negotiations will likely be difficult. EU members have yet to agree among themselves on what terms to offer and the British Parliament will the right to vote on the final agreement. Britain faces a hard Brexit and a deal will need to be signed by delivered 29 March 2019, although already the EU are making prevision for delivery in late 2020.

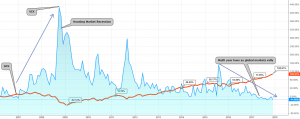

Throughout the year Cable finally recovered 50% of the losses of the pre-brexit vote highs. A bull trend formed from the lows of 1.2100, to finish the year testing the 1.3500 level.

Oil Market

Oil prices have rallied this year and are trading near $64 a barrel for Brent Oil, close to the highest since 2015, supported by the OPEC and non OPEC led effort. OPEC and its allies extended oil production cuts for nine more months in November after previous agreement in March failed to eliminate the global oversupply or achieve a sustained price recovery. The stated goal of the supply cut is to reduce inventories in developed economies which built up after a supply glut emerged in 2014. Then OPEC is expected to prolong its 1.5 billion barrels per day deal until the end of 2018.

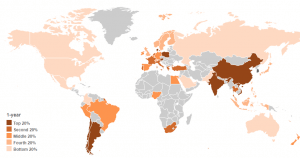

Market risk

Market risk has come from geopolitical concerns driven by rising nationalism, upcoming elections, succession concerns and acts of war. In Europe, the UK’s vote to leave the EU created uncertainty surrounding future trade negotiations. France, Germany and Italy potentially dealing further blows with a raise in anti-establishment forces. In the US much depends on President Trump and his administrations adoption of pragmatic policies. What is clear is the US has adopted a more assertive foreign policy which has led to friction between the US and its main trading partners. North Korea testing hydrogen bombs and tensions are at a high level.

This type of market risk applies to short term risk on risk off sentiment rather than longer term downtrend theme. It is clear to view over the year the performance of market has been positive and is not impacted by fear of political uncertainty.

Economic Conditions

The global growth anticipated by the IMF in the April World Economic Outlook has been met, the IMF revised its forecast and is now expecting slightly stronger growth. It now predicts growth of 3.6% for 2017 and 3.7% in 2018. The IMF’s forecast for the UK has remained the same as in its July report. It expects growth to slow from 1.8% in 2016 to 1.7% for 2017. For the medium term the UK’s growth outlook is highly uncertain and will depend in part on the new economic relationship with the EU and the extent of any increase in barriers to trade, migration and cross-border financial activity. Central Banks have been hawkish with ECB reducing quantitative easing, BOE raising interest rates for the first time in 2017 and the FED raising interest rates three times this year.

Rise of the Cryptocurrency

The best performing asset this year has been Bitcoin. Bitcoin is a peer-to-peer electronic cash system that doesn’t rely on trusting one central monetary authority and allows for anonymous, untraceable and untaxable transactions which is secured by cryptography. Bitcoin has been recently listed on CBOE and CME which allows for trading futures, derivatives and options. With a rise in value of 2500% in a year, it has the potential of being in a speculative bubble.