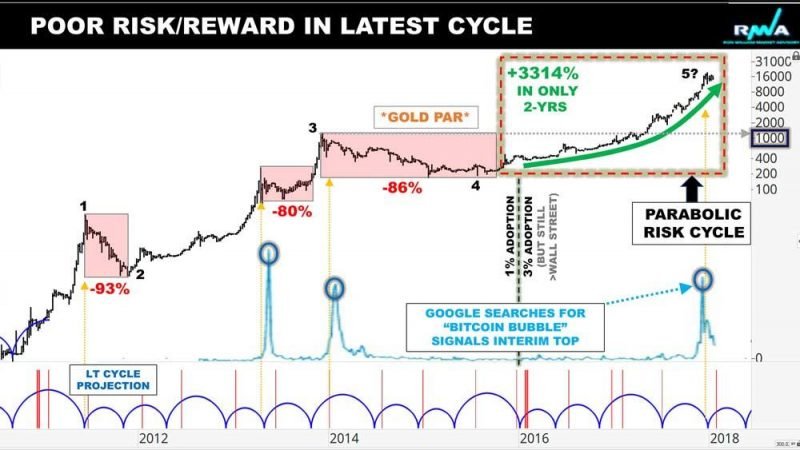

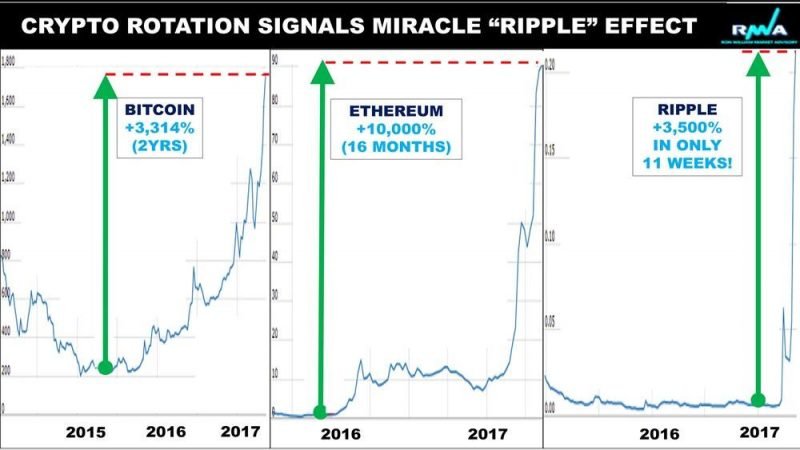

In this polarizing Crypto debate, it is important to recognize that the irrational price behavior of Bitcoin is simply diverging from the longer-term blockchain disruption opportunity. Blockchain technology is here to stay, with or without Bitcoin. Here and now, the speculation mania is only approaching an interim peak-stage. From a sentiment perspective, it is also noteworthy, that only a week beforehand, the CBOE and CME futures exchange had announced plans to incorporate Bitcoin, and by doing so, triggered a short-term contrarian signal. This helped release some of the excessive speculative froth, mostly fueled by inexperienced and over-leveraged traders. Further healthy price shakeouts and regulatory support would naturally give Bitcoin more credibility, thereby providing further infrastructure for creating ETFs, and other related digital investment vehicles. This is all required for “smart money” to build-up within this space and create more sustainable growth; not only in the financial sector, but across many other vital areas of the economy. Still of concern, is that many so-called experts have no way of knowing which cryptocurrency will be the winner that survives and takes-all. Bitcoin, albeit still a major player, only accounts for half of the crypto market capitalization, and will likely moderate as new ones are developed. In 2017 Bitcoin was surprisingly one of the worst performing of the top cap cryptos, and may in time serve as a fallen poster-child. Competitive gaps are spreading across the board; notably technological efficiency, transaction speed and cost. Meanwhile, rising stars like Ethereum and Ripple overtook in a very short-time (Fig 4), by 10,000% in 16 months and 3,500% in only 11 weeks!