Book a Free Consultation

Equity markets produced broad gains globally on Friday, with strong technology stocks and a retreat in Treasury yields lifting Wall Street.

The Dow Jones Industrial Average rose 347.51 points, or 1.39%, to 25,309.99, the S&P 500 gained 43.34 points, or 1.60%, to 2,747.3 and the Nasdaq Composite added 127.30 points, or 1.77%, to 7,337.39.

In stocks, technolgy shares climbed 2.17%. This was largely led by gains in Hewlett Packard Enterprise, which rose 10.5% and HP Inc, up 3.5%. The two companies, created from the split of Hewlett Packard Co in 2015, reported strong results and HPE announced a plan to return $7 billion to shareholders.

MSCI’s gauge of stocks across the globe gained 1.14%, with the pan-European FTSEurofirst 300 index rising 0.23% and emerging market stocks up 1.29%.

However, the performance of the past few weeks leads one to think that stock benchmarks, (especially in the U.S.) have grown more volatile over a few short weeks, prone to mind-bending swings in price within moments.

This volatility has been characterised in two ways. Either surging into the close or, more commonly, limping lower. For instance, the Dow during Wednesday trade lost the gains going into the close when a 303.24 point rally turned into a 167 point drop.

Typically the last hour or two of selling, has not, over the past two three years been a major focus for market watchers. That is not cased any longer as since the stock market has cast aside the cloak of low volatility and dormancy to become more volatile early in 2018, investors have been forced to be highly attuned to the balance of trading. This indicates the distribution of buy and sell orders to determine the end of day colour for equity markets.

Market-on-close orders refer to end-of-trading auctions that help to determine the final price for thousands of stocks at the conclusion of the day’s trade.

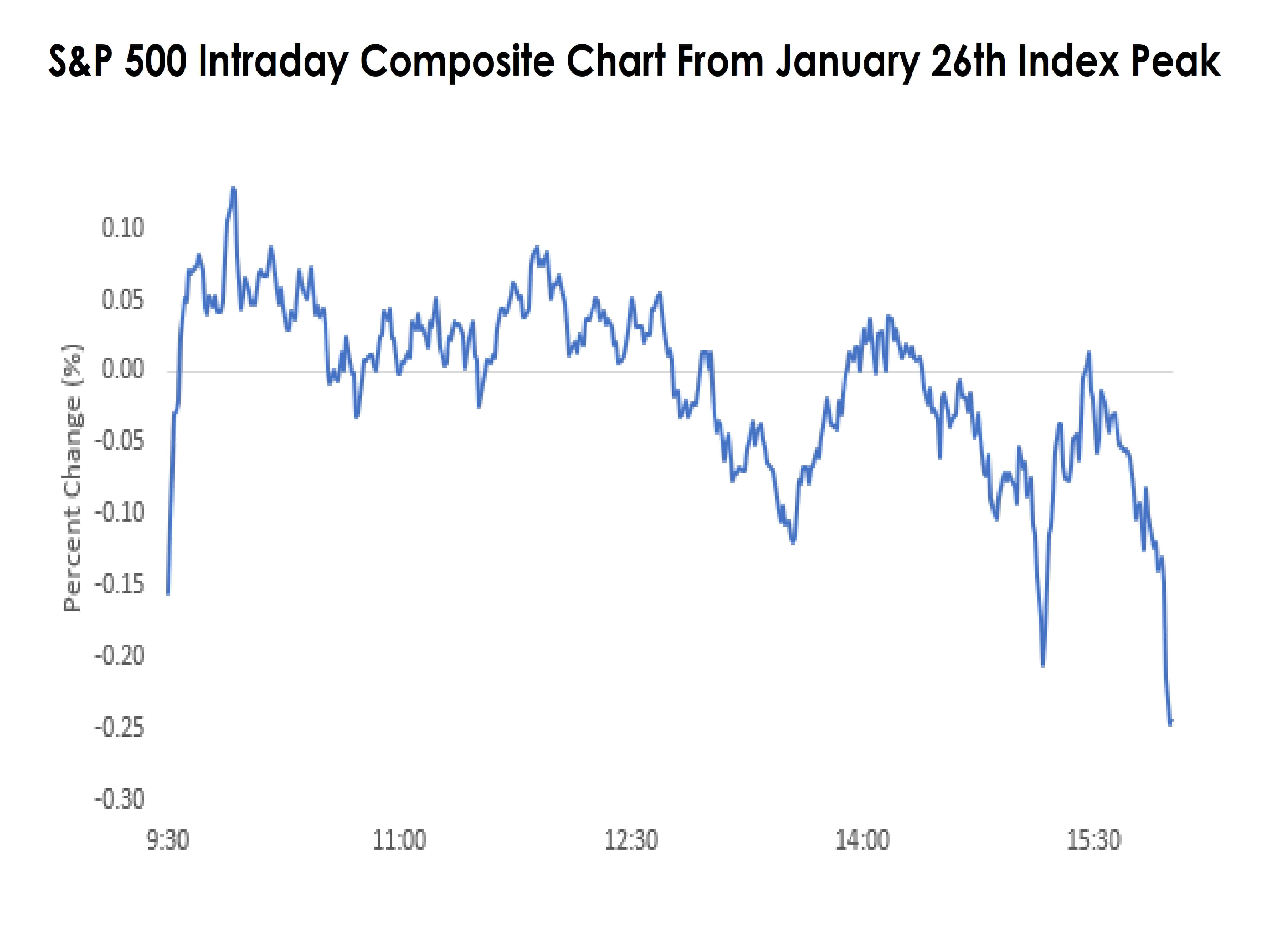

The chart below shows intraday composite moves for the S&P 500 since the Jan. 26 peak for the index

Some of the clearly visible surge lower for the S&P 500 in the afternoon looks to be linked to the markets running into resistance at technical trading levels. One should note, for example, the S&P 500 has retreated after hitting key 61.8% Fibonacci retracement levels from its 10% correction low at around 2,742.

U.S. Treasury yields fell as uncertainty about the recent stock market volatility helped boost bond demand and investors rebalanced portfolios near the month end.

The pull back in bond yields proved helpful for stocks, at least for the short term; as the consensus was that that higher bond yields were weighing on stocks.

Investors are ever on the lookout for attraction yield and it was noticeable that this week the was renewed interest in Sub-Saharan African (SSA) debt. There was strong demand for a $2 Billion offering of 10 and 30-Year debt from Kenya it attracted bids worth a whopping $14 Billion.

The 10-Year carried a yield of 7.25% (T10 + 431bps)and the 30-Year tranche 8.25% (T30 + 504bps).

There were similar stories for 12-Year paper sold by Nigeria at 7.14% and 20-Year offered 7.69%. There is a high expectation of strong demand from a new issue by Ivory Coast in the forthcoming week.

The Dollar edged higher as investors positioned for a more aggressive Federal Reserve to raise U.S. interest rates three times this year.

In its semiannual report to Congress released Friday, the Fed’s Washington-based Board of Governors looked past a recent stock market sell-off and inflation concerns, saying it sees steady growth continuing and no serious risks on the horizon that might pause its planned pace of rate hikes.

Gains in the Dollar pressured the Euro. The dollar index rose 0.16%, to threaten a break over 90 with the EURUSD down 0.29% to $1.2293.

Broader concerns have lingered globally over the last few weeks, including how far and fast U.S. interest rates may rise and what that would mean for global borrowing costs, risk appetite and business confidence.

The Federal Reserve in its monetary policy report said the pace of wage gains was moderate, weighed by low productivity. The monetary policy report was released ahead of Fed chair Jerome Powell’s testimony to Congress on February 27 to allow members of Congress and the public time to review the report.

The report said:

“The economic expansion continues to be supported by steady job gains, rising household wealth, favorable consumer sentiment, strong economic growth abroad, and accommodative financial conditions “(Original U.S. English spelling)

The focus will be on new Fed Chair Jerome Powell next week when he faces questions from both houses of the U.S. Congress in semi-annual testimony starting on Tuesday. His audience will include investors who greeted his early tenure with one of the fastest 10.0% falls in Wall Street stocks in history this month.

Gold prices have lost significant ground during the past week, primarily due to a reversal in dollar fortunes.

A recovery in the U.S. Dollar Index, coupled with a fresh increase in bond yields, pushed spot prices to one-week lows below $1,325/Troy Oz before consolidation took over. Gold’s spot market price dropped 0.2% to $1,328.97/Troy Oz. It shed about 1.4% this week, its biggest weekly decline since early December.

The impact of U.S. inflation and monetary policy expectations will continue to ripple across all asset classes and will inevitably be a key driver of gold prices during the week ahead. Market sentiment is somewhat cautious on gold over the short term given that the Dollar rally is still not over, especially in the light of U.S. Treasury yields remaining elevated.

Oil prices rose to their highest in more than two weeks, supported by the shutdown of the El Feel oilfield in Libya and upbeat comments from Saudi Arabia that an OPEC-led effort to cut stockpiles is working.

U.S. crude (WTI) rose 1.26% to $63.56 per barrel and Brent was last at $67.30, up 1.37%.

Monday 26th

14:00 EZ ECB President, Mario Draghi Speaks

15:00 USA New Home Sales Jan Expect 655K Prior 625K

Tuesday 27th

13:30 USA Core Durable Goods Orders Jan Expect 0.4% Prior 0.7%

15:00 USA Conference Board, Consumer Confidence Jan Expect 126.3Prior 125.4

15:00 USA Fed Chair, Jerome Powell Testifies

Wednesday 28st

08:55 GER Unemployment Change Feb Expect -17K Prior -25K

10:00 EZ CPI YoY Feb Preliminary Expect 1.2% Prior 1.3%

13:30 USA GDP QoQ Q4 Preliminary Expect 2.5% Prior 2.6%

13:30 USA Pending Home Sales MoM Jan Expect 0.4% Prior 0.5%

13:30 USA Crude Oil Inventories Prior -1.616 Million

Thursday 1st

08:55 GER Manufacturing PMI Feb Expect 60.3 Prior 60.3

09:30 UK Manufacturing PMI Feb Expect 55.1 Prior 55.3

15:00 USA Fed Chair, Jerome Powell Testifies

15:00 USA ISM Manufacturing PMI Feb Expect 59.0 Prior 59.1

Friday 2nd

09:30 UK Construction PMI Feb Expect 50.7 Prior 50.2

13:30 USA Non-Farm Payrolls Feb Expect 180K Prior 200K

13:30 USA Unemployment Rate Feb Expect 4.1% Prior 4.1%

Have a great week