The Foreign Exchange market (known as forex or FX) is a market to exchange one currency for another for immediate or future delivery. It’s the largest and most liquid market in the world, with a wide range of participants, from banks and brokers to corporations and individuals. It is made up of a network of counterparties who buy and sell currencies between themselves at an agreed market price, either for speculation or for hedging currency risk.

For the vast majority of people going about their daily lives, foreign exchange is only relevant when planning an overseas holiday, but for currency traders, forex trading offers a great opportunity to earn profits from trading. The forex market trades 24 hours a day, five days a week, with currency values being affected by political and macroeconomic news, as well as technical analysis and investor psychology. These price fluctuations enable traders and investors to speculate on the future value of a currency, and while rewards can be huge, these opportunities do not come without risk.

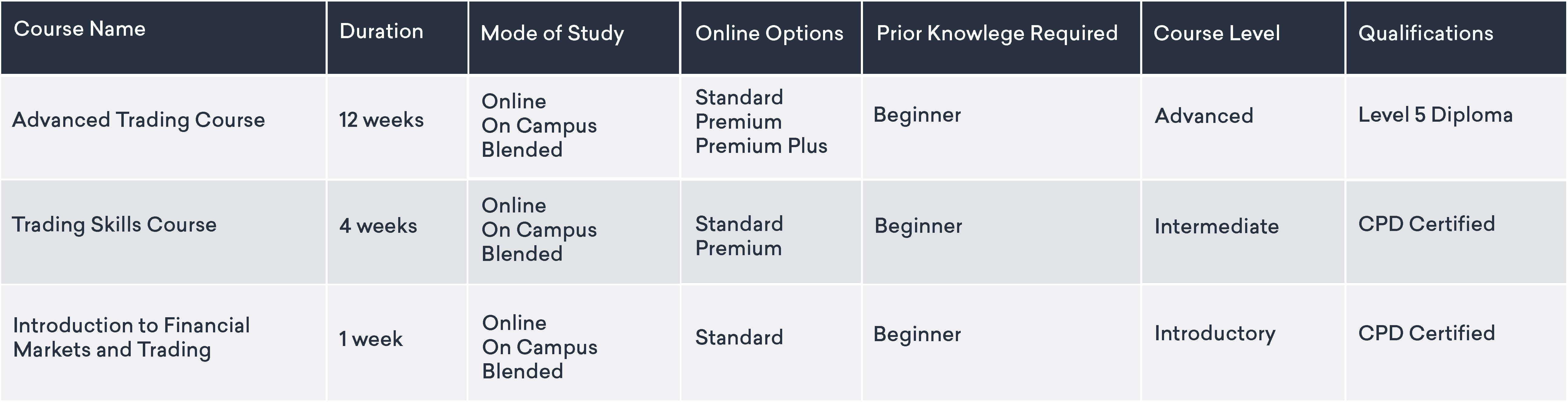

LAT is a dual-accredited provider of training and education for individuals wishing to learn how to trade and how financial markets work. Our trading courses provide the knowledge and practical skills to enable individuals to trade any assets with a robust and structured trading strategy, although forex is a particularly popular asset class for many traders.

We can also give advice on which broker will suit you best – since we take no rebates from any brokers, we can be 100% impartial in our advice.

We build our teaching on four pillars of knowledge:

We believe that the best recipe for success is to not only teach our students the various concepts and strategies involved in trading, but also to show them how to implement forex trade strategies with regular live market analysis. We do this by making ourselves available to answer questions and provide help and advice for the maximum amount of time:

Whether you’ve been trading the markets for a while or are just getting started on your trading journey, our courses assume no prior knowledge, and are suitable for traders of any level.

Forex trading strategies can take a long time to master, especially if you are only aware of the conventional methods of trading that you can find anywhere online. Our courses provide the in-depth knowledge to enable you to develop your own methods (under the guidance of our trading mentors) and then review and enhance them as your trading experience grows.

Unlike other forex trading courses which offer supposedly “proven, guaranteed” strategies to make you money (none of which provide the rich rewards that they promise!), we teach a more personal trading development method, to empower you with the knowledge and skills to reach your personal trading goals.

Forex trading is the oil which lubricates all global financial markets, and is an essential element of all international business. Forex trading is carried out by banks, brokers, corporations, investment funds and individual investors. The collaboration between these different entities generates an extremely liquid global market that impacts and shapes economies and businesses around the world.

The global forex market is critical to support international trade, as countries import and export goods and services across international boundaries. A country’s currency also acts as a pressure valve for their economy, helping to avoid boom-bust economic cycles.

For example, if a country has a weak economy, the central bank will lower (or cut) its interest rates, which will (generally) cause its currency to devalue. The weaker local currency will then make that country more competitive in international markets, stimulating exports and helping their economy to recover.

The opposite is true for strong economies, since higher interest rates usually strengthen the currency, making the country less competitive abroad; hence, it should prevent the economy from overheating.

So, for both governments and multinational companies, the forex market plays a fundamental role in their ongoing growth and prosperity.

The most obvious benefit of forex trading is the ability for traders and investors to make profits, but before we look into the reasons that forex is so good for trading, we need to know what forex trading actually involves.

Although currencies have been around for hundreds of years, the actual forex market as we know it today is relatively young. It came into being in the early 1970s, after the breakdown of the Bretton Woods Agreement. Before this time, all international currencies were pegged to the US dollar within a tight range, so there was very little volatility and no opportunity for speculative profit.

Forex trading is now carried out by a wide range of participants across the world:

Since currencies are traded all around the world, the forex market remains open throughout the week, from Sunday evening in the UK (when Australian markets open) to Friday evening around 10pm (when US markets close). This is good for shorter-term traders since they can enter/exit positions at any time, day or night, throughout the week, so they don’t suffer from ‘gapping’ as markets open and close (during the week at least).

On the other hand, equity markets do open and close each day, with prices often ‘gapping’ up (or down) at the opening of the market as a result of good (or bad) overnight news. These gaps can generate unexpected (and sometimes significant) losses for traders holding positions from one day to the next.

While some investors may speculate over a number of months or years, the vast majority of forex speculation takes place over a much shorter timeframe, sometimes just a few minutes or even seconds.

Longer-term investors and fund managers generally use a more fundamentally-based trading approach, looking at macroeconomic data, political news and economic cycles to help predict future forex rates. They may also take advantage of interest rate differentials between countries via what’s known as a ‘carry trade’. Here, they buy a currency with high-interest rates (earning high interest), and sell a currency with low-interest rates (paying out very little interest), hence earning a profit from the difference in the interest rates, usually over a number of months or even years.

However, for most speculative traders, short-term day trading, or swing trading (slightly longer term) can be very profitable. Due to the huge liquidity in the forex market, bid-ask spreads are very tight (making it very cheap to buy and sell large amounts of currency). Also, for private individuals, retail brokers offer leveraged trading accounts, which enables small investors to trade much bigger size, often up to 100 times their actual funds. This, of course, is a double-edged sword, since it can multiply profits, but also losses. In order to be profitable, these short-term traders still need to understand the macroeconomic fundamentals that affect currency values, as well as the charts and technical analysis to make their trading decisions.

Any company doing business overseas – whether buying or selling products and services – is at risk from currency fluctuations. This is called currency risk (also known as FX risk or forex risk), but it can be reduced or even eliminated by hedging using FX forwards, swaps or futures.

For example, if a U.S. car maker forecasts that it will sell a certain number of cars in the U.K. during a given month in the future (and can therefore estimate the amount of GBP they’ll receive in that month), they can sell in advance the expected number of pounds and buy dollars for the required delivery date. (i.e. They sell short GBP/USD). Then, when the cars are sold, and the GBP have been paid by the customers, these pounds will be exchanged into U.S. dollars on the pre-determined date at the already-agreed forward price. With the GBP-USD exchange rate fixed in advance, the U.S. car company is in a position to fix its UK prices in advance and maintain its profit margins.

The same occurs for investment firms which may be investing in overseas equity markets. When doing so, they should make sure to hedge their forex risk to avoid any currency fluctuations from eating into their equity investment profits.

The formal regulation of both interbank and retail markets varies widely from country to country, so it’s important for all traders to understand any potential risks (such as counterparty or credit risk) before getting started. The interbank market involves banks trading with each other around the world, so they need to assess and mitigate these risks by establishing internal processes to protect themselves as much as possible.

For small retail traders, they need to carry out due diligence of their broker, since the quality of government regulation can vary significantly around the world. Brokers tightly regulated in U.S. and U.K, but may be more lightly regulated in other countries with less stringent oversight. Some of these less-regulated brokers may re-quote prices or even trade against their own customers, so retail traders should be careful when selecting their broker. It is also sensible to choose a broker that’s been established for at least ten years, and to find out the extent of any account protection availability in case the broker goes bust or the market hits a crisis.

Leverage (called margin trading in futures markets) is the ratio between the actual amount of money in your trading account and the amount of money you are able to trade with. It effectively enables you to gain greater exposure to positions with a relatively small amount of capital. Typical leverage for retail trading accounts can be anything from 5 times to 100 times leverage or more, and has many benefits:

Personally, I measure my trading risk in absolute money terms, such as risking a maximum of, say 1% of my trading account on any single position. In this way, my losses are fixed to manageable levels. Of course, limiting your risk to just 1% will mean that your profits are also limited. It’s your choice how much of your account you want to risk on each trade, and for smaller trading accounts, you may wish to increase this to 5% or even 10%, but make sure to be aware of worst case scenarios.

The essential thing to remember is to keep tight control over the amount of money you’re risking on each trade, as well as across your whole trading portfolio. If you can do this, then you’ll stay in the game and your stress levels will remain low.

Paddy Osborn, Academic Dean, LAT